EXPLORE OUR PLATFORM

How It Works

OUR USE CASES

Explore Industry Applications

Our software is designed to verify both organizations and individual borrowers, providing next-level KYB and KYC verification, and ensuring a secure closing environment for a variety of industries.

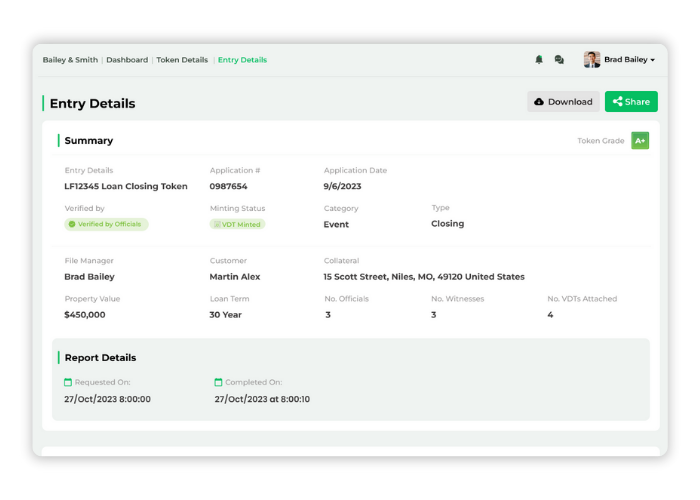

Loan Closing Tokens

Our Validated Data Tokens capture attribute metadata for closing events, and our comprehensive reporting system ensures transparency and truth every step of the way.

Verified Digital Identities

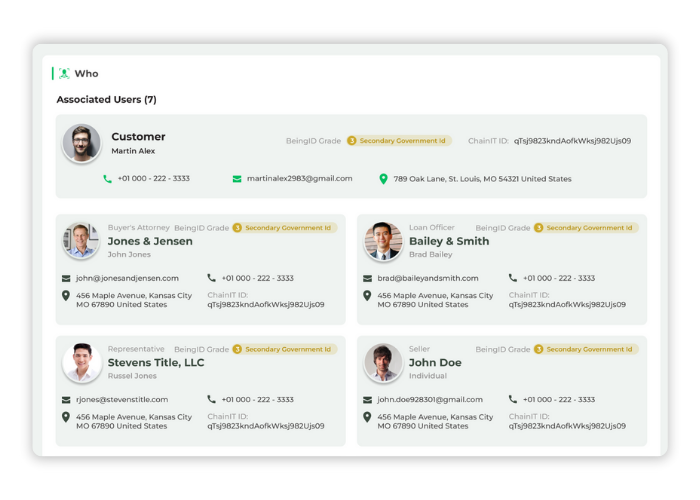

ChainIT IDs verify both organizations and individual borrowers with facial biometrics and government database validation to ensure secure closing transactions and compliance for each stakeholder involved.

Automated Disbursements

By leveraging digital wallets and smart contracts, VUMP automates the approval and payment process for any type of loan, from a simple personal loan to a large construction loan. You set the conditions, and VUMP ensures all conditions are met before securely disbursing funds to each verified party.

Why Choose Us

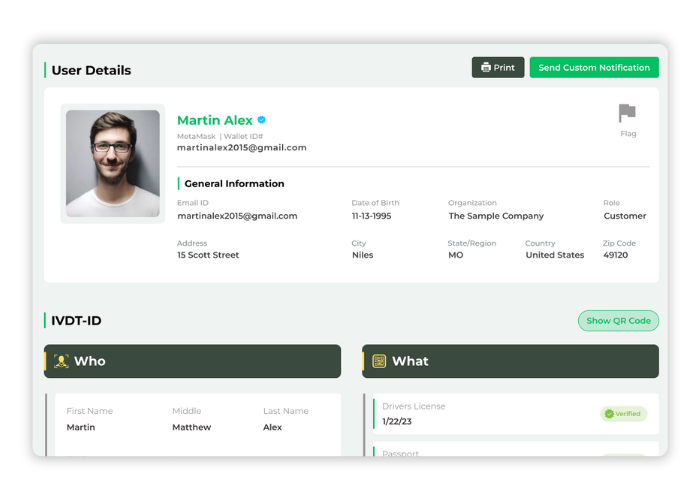

Comprehensive Biometric Verification and Digital Identities

VUMP harnesses the power of digital identities, biometric validation, and government-validated ID documents to paint a complete, fraud-proof portrait of every user. Lenders no longer have to rely on trust; they can instantly access the truth at their fingertips, ensuring a more secure and transparent lending process.

How it Works

For Lenders

Utilize VUMP for Streamlined Loan Processing

Step 1Receive Loan Applications

Greenlight Data seamlessly integrates with your existing system to improve decision-making without disrupting operations.

Step 2

Step 2

Create New Loan File

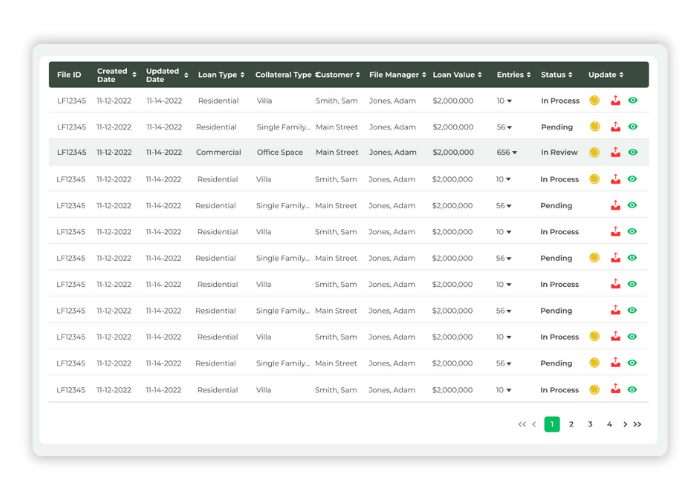

Access the dashboard’s customer files section, click “Create Loan File,” and enter relevant details.

Step 3

Step 3

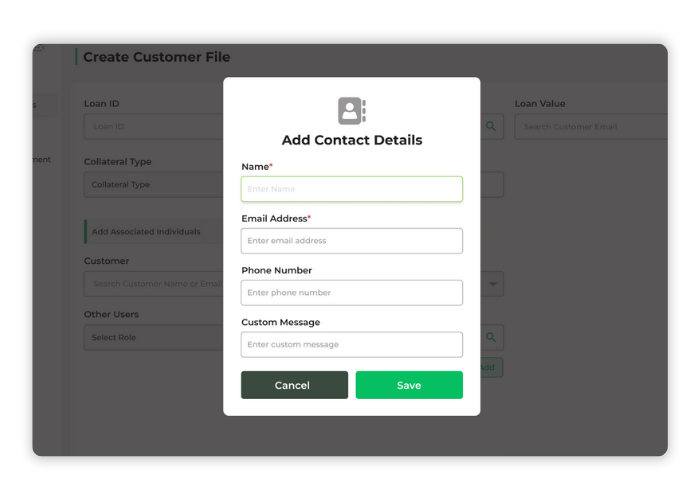

Invite the Applicant

Enter the borrower’s contact info and send an invitation to create a ChainIT ID.

Step 4

Step 4

Assign Roles

Associate users within the customer file, invite them to create ChainIT IDs if necessary.

Step 5

Step 5

Access Applicant's Digital Identity

View key facts and document validation status.

Step 6

Step 6

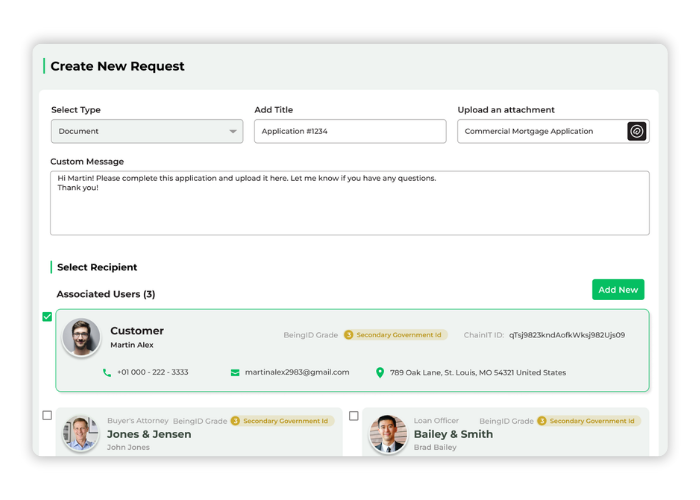

Request Documents

Easily request additional documentation, track progress, and receive notifications upon submission.

Step 7

Step 7

View Metrics and VDT Information

Gain insights through Validated Data Tokens, location tracking, and audit logs.

Step 8

Step 8

Verify Information and Make Decision

Evaluate the loan application using gathered data and update the status.

Step 9

Step 9

Create Loan Closing VDT

Capture all closing event details and involve witnesses with ease.

Step 10

Step 10

Update Loan File Status

Close or archive the customer file upon completion.

Step 11

Step 11

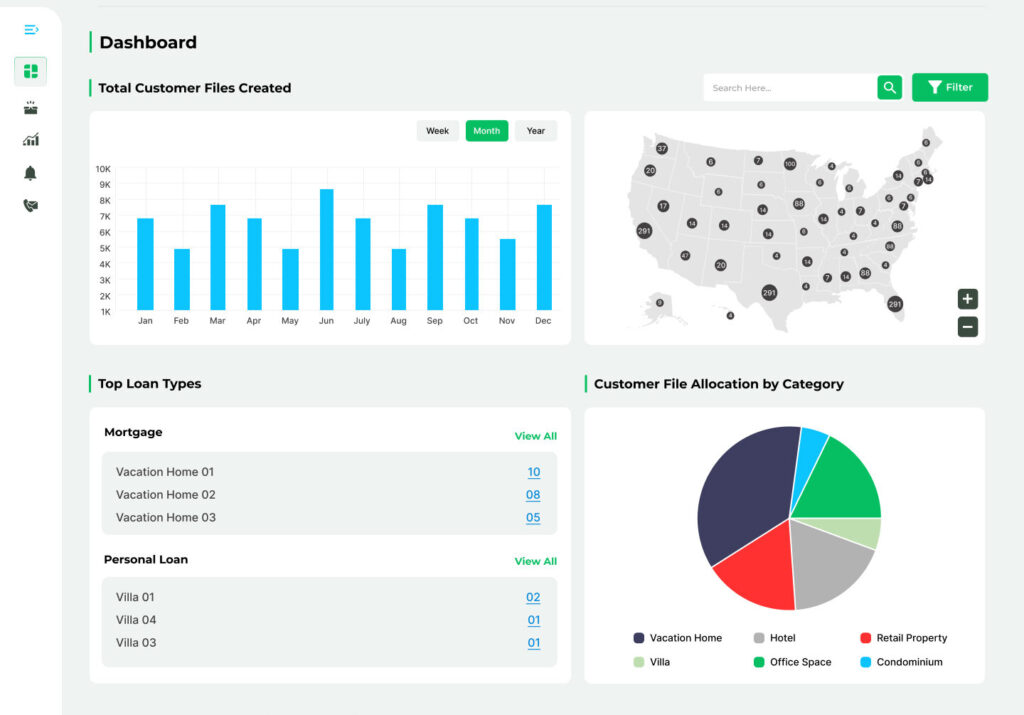

Analyze Metrics and Generate Reports

Access metrics and generate reports for enhanced decision-making and organizational insights.

OUR BENEFITS

Ensuring the Truth

Our software establishes a secure foundation by creating records that are resistant to tampering, ensuring the authenticity of every transaction.

Immutable Records

Blockchain ensures secure, authentic transactions with comprehensive documentation and reporting.

KYC and KYB Onboarding

Biometrics, government IDs, and digital wallets cut identity fraud risks for borrowers and improve verification processes for lenders.

Automated Smart Disbursements

Fully-configurable workflows make it easy for lenders to manage and monitor draw requests.

What we offer

Streamlined Loan Processing

VUMP offers an efficient and reliable method to verify every borrower, document, and interaction for all transactions.

Verify borrowers during the application process

Securely collect documents and signatures

Generate reports and view trends over time

Why choose vump

Ensure secure and verified lending operations.

100% of the time.

Why Choose Us

Advanced Metadata Capture for User Activity Tracking

VUMP utilizes comprehensive metadata capture for every document or event. This metadata encompasses geolocation, digital identities, timestamps, and photos, enabling you to closely track user activity and swiftly identify any irregularities.

Why Choose Us

Immutable Audit Trail

VUMP employs a distributed ledger-based immutable audit trail that records every step of the lending process. This trail includes document submissions, user interactions, and key decisions. The immutable nature of this trail ensures transparency and truth throughout the lending journey, setting a new standard for accountability in the industry.

step by step

Use Cases

Real Estate Loan Closings

Streamline real estate closings and disbursements by leveraging advanced identity verification and smart contracts to ensure secure, efficient transactions.

Closing Attorneys

Securely manage the loan closing process, ensuring compliance and reducing fraud through automated identity verification and immutable documentation.

Personal Loan Closings

Our biometric-authenticated eSignature capabilities, paired with unparalleled KYC onboarding, ensure the most secure remote lending operations.

Construction Draw Management

Automate disbursements through smart contracts, ensuring that payments are securely released only when predefined conditions and milestones are met.

WHO WE ARE

Patented by Black Ink Technologies™

Black Ink Technologies is the developer of multi-patented integrated hardware and software platform,ChainIT, for verifiably connecting physical world objects, services, and events to the digital world with immutable blockchain technology. The company offers end-to-end permanent zero-trust products and services and connects the physical to the digital for Web 3.0, metaverse, or tokenization, thereby facilitating contract automation and value transfer to improve efficiency and limit stakeholder risk.

Explore BIT

Schedule Your Free Demo

Book a demo with our team to explore how VUMP ensures reliable outcomes in loan closing.

About Us

We eliminate opportunities for fraud and ensure that data accuracy and integrity are maintained with easy validation.

Powered by ChainIT

Pages

Solutions

-

Individual Digital Identity

-

Organizational Digital Identity

-

Loan Closing Token

-

Token Grading System

-

Touch Audit

-

ChainIT Doc

Social Media

Facebook-f

Youtube

Linkedin-in