OUR SOLUTIONS

The New Standard for Verified Data

Ensure secure and verified lending operations.

100% of the time.

Immutable Records

Blockchain ensures secure, authentic transactions with comprehensive documentation and reporting.

KYC and KYB Onboarding

Biometrics, government IDs, and digital wallets cut identity fraud risks for borrowers and improve verification processes for lenders.

Automated Smart Disbursements

Fully-configurable workflows make it easy for lenders to manage and monitor draw requests.

Our features

Transparency. Security. Accuracy.

By implementing smart contracts, multiple layers of authentication, and innovative features like our comprehensive grading and auditing system, VUMP ensures transparency, security, accuracy, and integrity of data. This platform streamlines processes, reduces risk, and improves transparency among buyers, lenders, and attorneys in the financial industry.

touch audit

Ensuring Truth at Every Milestone

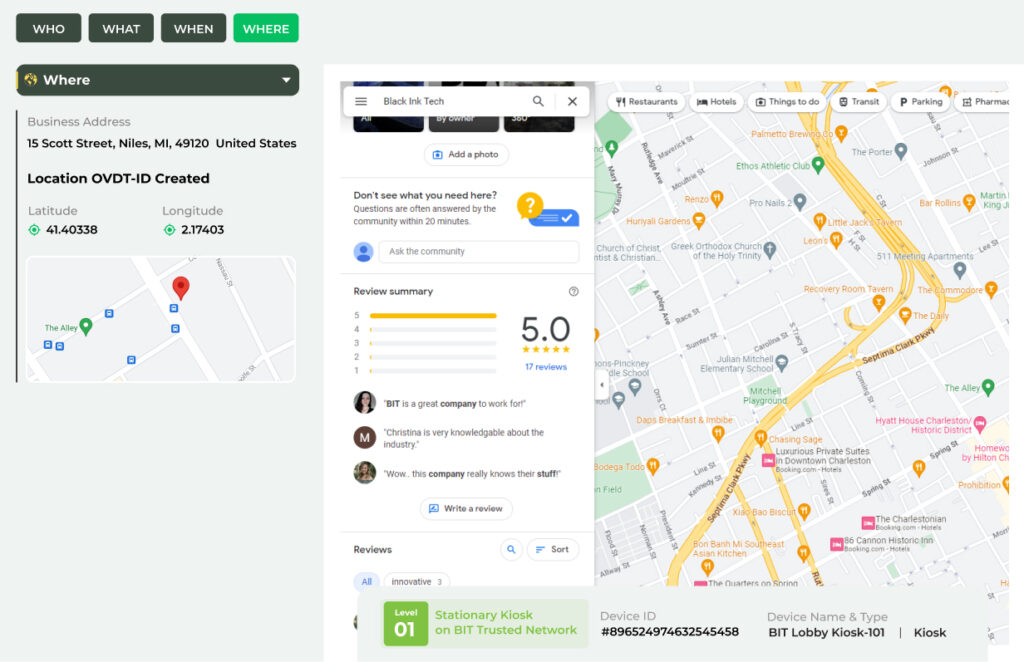

WHERE

Automatically Monitor Locations

Location information is immutably recorded for each piece of documentation, providing insights and ensuring transparency.

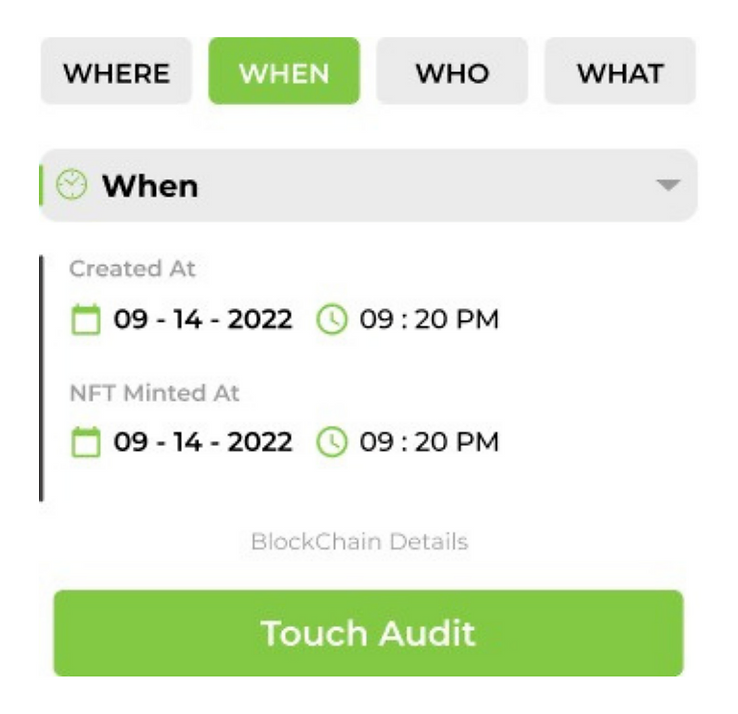

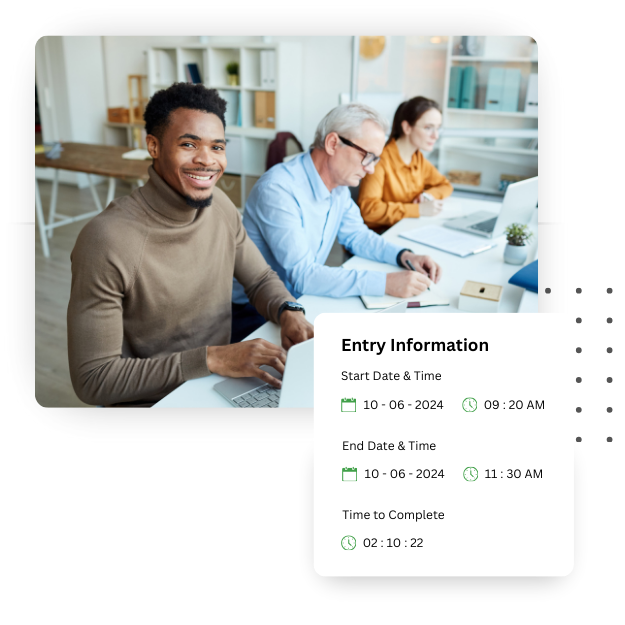

WHEN

Track Timestamps

Permanent timestamps are collected for each document and event, recording the precise time information is entered.

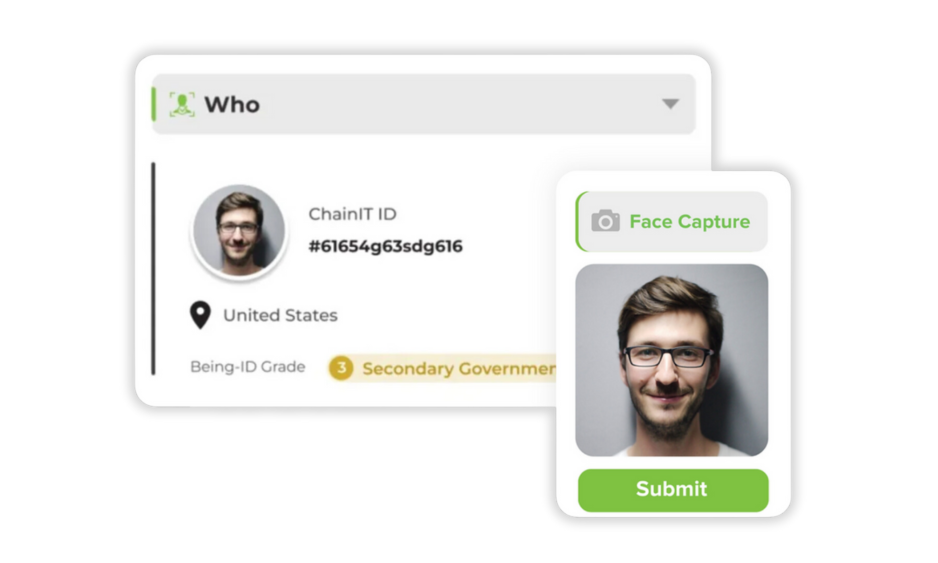

WHO

True Owner Verification

Add biometric verification of the token owners, creators and witnesses. Individuals are verified using only authenticated photos, IDs and documents.

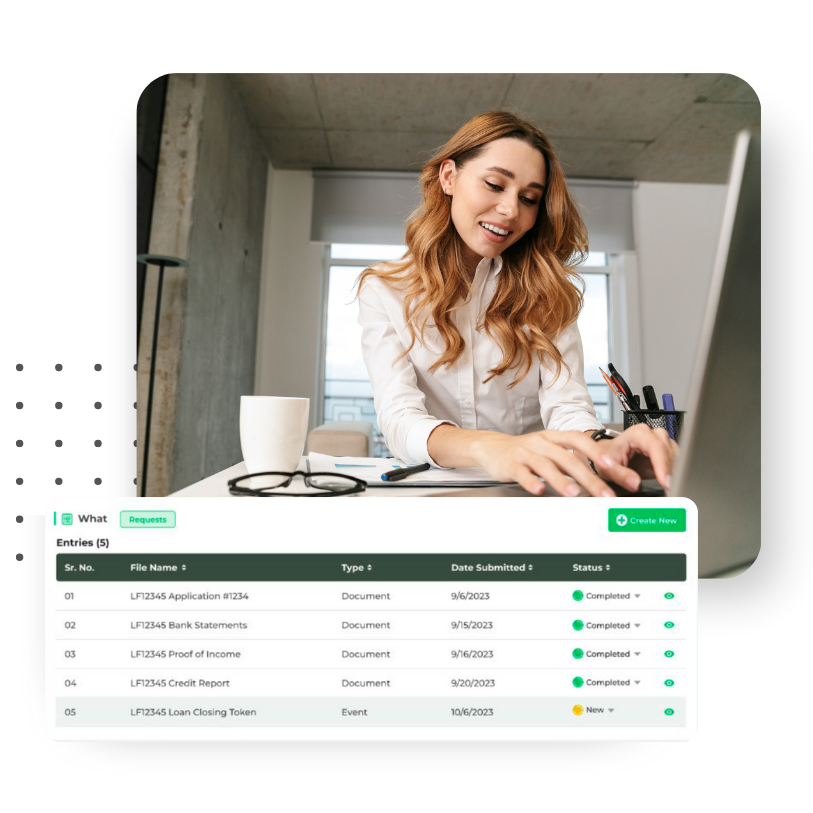

WHAT

Easily Integrate and Share Records

Each piece of documentation is connected to a QR code, which can be integrated seamlessly into legacy systems, or shared with interested parties.

key features

Explore Our Solutions

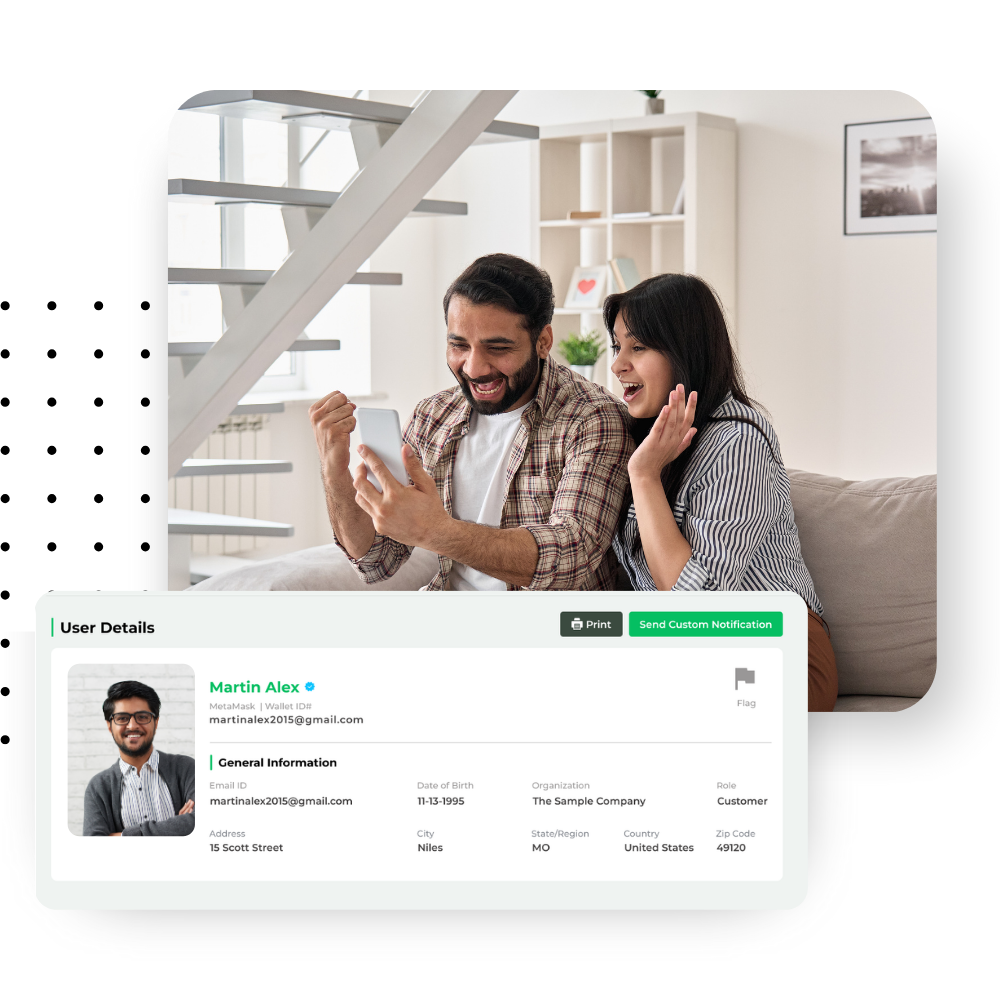

Verify individual customers

Individual Identity Verification

Our system utilizes biometrics and government-validated IDs to verify the identities of all participants in a transaction. This ensures that only authorized individuals are able to access.

Verify business customers

Organizational Digital Identity

In addition to validating the individuals, we also verify businesses to prevent unauthorized transactions and protect lenders and borrowers from financial losses.

Create an immutable record of a transaction

Loan Closing Token

We provide robust reporting capabilities that leverage the metadata collected in VDTs. Lenders and stakeholders can access detailed reports that offer insights into every aspect of the loan closing events.

Where Transparency Meets Simplicity

Touch Audit

Touch Audit™ revolutionizes the way users interact with data. It empowers individuals and organizations to gain instant access to key details of any product, service, or event with a simple touch or click. Gone are the days of sifting through complex data sets; Touch Audit™ simplifies the validation of metadata, providing a transparent and reliable source of truth behind the information.

Discover More

Where Data Quality Matters

Token Grading System

Our Validated Data Tokens are graded with our advanced Token Grading System, providing a standardized method of assessing each VDT. This grading scale assigns a grade based on the level of validation of the tokens, utilizing four Computing Device Reliability (CDR) Levels and ten established BeingID Levels with varying degrees of credibility and assurance.

Collect Enhanced documentation records

ChainIT Doc

ChainIT Doc harnesses the power of the ChainIT platform to encapsulate documents within a Validated Data Token™ (VDT). Paired with biometric authentication, users can easily upload and sign documents, embedding them with layers of data that guarantee their authenticity.

Automate Payment Approvals and fund disbursements

Smart Contracts

Whether handling a one-time disbursement or multiple staged draws, smart contracts streamline the approval and release of funds. As soon as predefined conditions are met and verified, the smart contract triggers the automatic disbursement of funds into secure digital wallets. This process minimizes administrative overhead, lowers risk, and mitigates fraud.

discover more

What Sets Us Apart

Immutable Recordkeeping

Our blockchain-powered system creates VDTs for each transaction, document, and event, documenting the entire process in a tamper-proof and immutable manner. This record includes details of the participants, documents signed, and key milestones.

Referential Integrity

VDTs are linked to one another, allowing for easy reference and verification of the entire loan closing process. Each event can be traced back to its origin, providing transparency and reliability.

User-Friendly Interface

Our software is designed for ease of use by lenders, borrowers, and closing agents. Participants can confidently engage in loan closings using mobile devices or tablets.

Biometric ID

Confirms the individuals involved in VDT creation by generating a unique biometric template.

Data Attributes

The VDT records details like GPS location, timestamps, biometrics, VDT IDs, images, and documents.

Grading System

Assesses each VDT based on validation levels.

Validated Data Tokens (VDTs)

Digital tokens connected to physical objects, services, or events.

Touch Audit

Provides instant verification of the token grade and VDT data through QR codes.

Floating Kiosks

Portable, reliable devices on the trusted network. They offer brand customization.

Learn More

hardware

Edit Template

LEARN MORE

Ready to Get Started?

Schedule a demo with our team to get a deeper understanding of how VUMP can seamlessly deliver reliable results for your financial operations.

Get In Touch

Reach out to us with any inquiries or feedback. Our team is dedicated to providing support throughout your experience using VUMP.

(843) 872 6991

450 Meeting St. Charleston, SC 29403

learn more

Schedule a Demo

Schedule Your Free Demo

Book a demo with our team to explore how VUMP ensures reliable outcomes in loan closing.

About Us

We eliminate opportunities for fraud and ensure that data accuracy and integrity are maintained with easy validation.

Powered by ChainIT

Pages

Solutions

-

Individual Digital Identity

-

Organizational Digital Identity

-

Loan Closing Token

-

Token Grading System

-

Touch Audit

-

ChainIT Doc

Social Media

Facebook-f

Youtube

Linkedin-in